LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

Debt 101: What Is Debt?

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Debt is simply money you owe to another party. If you borrowed money from a bank or lender, or even if you charged a purchase on your credit card, then you have debt. There are many different kinds of debt, and not all debt is bad. Debt that’s used responsibly can help you build your credit history and reach financial milestones like purchasing a house or a car. But debt that you can’t repay can hold you back from reaching your goals.

Learn more about the different kinds of debt and how to manage them.

What is debt?

Put simply, debt is an amount of money transferred from one party to another with the intention of repayment. Debt can be used to cover costly expenses that the borrower might not be able to make otherwise, such as paying for college tuition. Most debt agreements, such as loans and credit cards, accrue interest, which is your cost of borrowing.

How much debt is considered normal?

There’s really no such thing as a “normal” amount of debt, since each household’s financial situation is as unique as the people within it. But it doesn’t hurt to compare. In 2018, the average American household with at least one type of debt owed $144,100. In 2020, borrowers pay $1,233 toward debt each month on average.

| Average monthly debt payments in the US | ||

| Average Total Monthly Payments per Person | $1,233 | |

| Average Monthly Payments for People With Each Type of Debt | ||

| Average Monthly Mortgage Payment | $1,255 | |

| Average Monthly Car Payment | $493 | |

| Average Monthly Personal Loan Payment | $458 | |

| Average Monthly Credit Card Payment* | $244 | |

| Average Monthly Student Loan Payment | $300 | |

| Average Monthly Payment for Other Debts | $248 | |

*The average amount paid towards credit cards in the previous month. Unlike the set installment payments for most loans, revolving credit lines have no fixed monthly payment.

Note: Average monthly payments for each debt type do not add up the average total monthly payments per person because not everyone has every or any type of debt. The value for joint accounts was halved for individual debtors to reflect shared responsibility for the payment.

Source: LendingTree.com

What is a good debt-to-income ratio?

When deciding if you’re a good candidate for a loan, the lender will look at several factors, including your debt-to-income (DTI) ratio. A good DTI ratio depends on your financial goals; for example, a mortgage borrower should aim for a DTI ratio of 36% or less. The DTI ratio you need to secure financing depends on the lender, the type of loan and your credit score.

Monthly Debt Payments ÷ Monthly Gross Income = DTI Ratio

To calculate your DTI ratio, add up all the debt payments you make in one month. Divide that number by your gross (pretax) monthly earnings.

Secured debt and unsecured debt, defined

Debt can be secured or unsecured. Secured debt is backed by collateral, typically an asset like a car, house or savings in a bank account. Auto loans and mortgages are common types of secured debt. If you fail to pay your debt, the lender can seize your collateral to make up for their losses. In the case of a mortgage, not paying your secured debt could result in a foreclosure.

Unsecured debt is not backed by an asset. Common types of unsecured debt are credit cards and personal loans. If you become delinquent on these debts, there are no assets for the bank to seize; however, the lender or card issuer may send your debt to a collector, who will try to recoup the money, and sometimes sue for payment.

Good debt vs. bad debt: What’s the difference?

Debt isn’t inherently good or bad, but there are certain qualities that differentiate debt that helps you reach your financial goals and debt that holds you back from those goals.

High-interest debt, such as revolving credit card balances, keep you paying for purchases you made on your card for months to come. Payday loans with triple-digit APRs and short repayment periods can trap you in a cycle of debt, meaning you have to keep taking out new loans to pay the current one. These are examples of bad debt.

But debt can also help you become a homeowner, attain higher education and take control of your finances. Mortgage debt allows you to invest in a house that will appreciate in value and build equity. Student loans help you achieve an education that can increase your earning potential. And debt consolidation loans can help you refinance high-interest revolving credit card balances and pay them off in fixed monthly payments. (Refinancing is the process of taking out new debt to pay off existing debt for a lower rate.)

While there’s always a gray area between good debt and bad debt, here are some general guidelines to follow:

| Types of good debt | Types of bad debt |

| Mortgage debt | Revolving credit card balance |

| Student loan debt | High-interest debt, such as payday loans |

| Auto loans with short- to medium-length terms | Longer-term auto loans |

| Personal loans with good terms | Personal loans with bad terms |

| Credit card debt that’s paid off every month | Any debt which you cannot afford to repay |

Types of debt and how to handle them

Mortgage debt

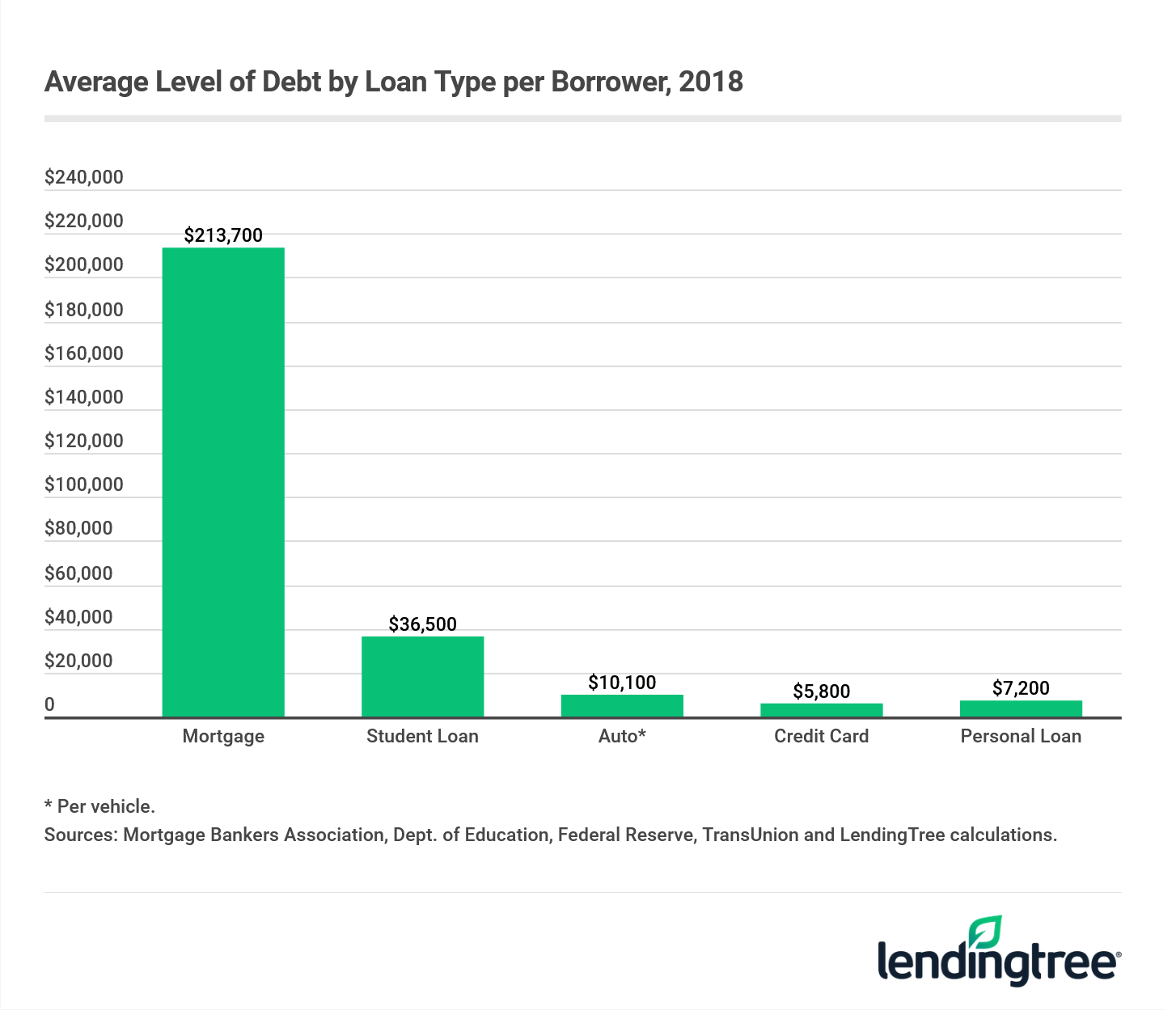

By far, mortgage debt is the largest debt on average for American households. LendingTree data found that the average mortgage balance was $213,700 in 2018. However, that doesn’t mean it’s necessarily any more burdensome than other types of debt.

How to handle mortgage debt: One of the best ways to manage your mortgage debt is simply to pay it on time every month. To go the extra mile, you could pay more toward your mortgage debt each month to pay off the loan faster and save money on interest charges. Keep in mind that you may be on the hook for prepayment penalties if you go this route. You could also consider refinancing your mortgage for a lower rate, which will save you money over the life of the loan.

However, if you’re having trouble paying your mortgage, there are a few options you can consider:

- Apply for forbearance through your lender. This allows you to put your mortgage payments on pause or reduce them while you get your finances back on track. When entering forbearance, make sure you understand how your servicer will want the balance repaid.

- Refinance your mortgage for more favorable terms. You may be able to secure a lower APR, lower monthly payments or a faster payoff timeline by refinancing your mortgage. Consider factors like closing costs and other fees when refinancing.

- Speak with a HUD-approved Housing Counseling Agency. A mortgage counselor may be able to help you talk with your mortgage servicer to avoid foreclosure.

Credit card debt

Credit cards can give consumers the power to make purchases and earn rewards, but credit card debt can be costly when you’re only making the minimum payment.

The average APR for new credit card offers is 19.28%, ranging between 15.68% to 22.87% depending on creditworthiness, according to July 2020 data from CompareCards. The average credit card balance is $6,354. If a borrower were to make the minimum monthly payment (4% of the total balance) on that amount of debt with a 19.28% APR, it would take them over 12 years to pay off the debt, with interest charges totaling more than $4,000.

Auto loan debt

Auto loans give consumers the power to purchase a car, which can be necessary for many people just to get to work or the grocery store. Auto loans compose 9.5% of American consumer debt, and they’re no small burden on the average household’s budget. Check out the average monthly auto loan payment, according to January 2020 LendingTree data:

- New vehicles: $550

- Used vehicles: $393

- Leased vehicles: $452

Auto loan debt isn’t inherently bad, but cars depreciate in value quickly. To get the most favorable terms on an auto loan, borrowers should compare offers from multiple lenders and choose the option with the lowest APR and a reasonable payoff timeline.

How to handle auto loan debt: Avoid long-term auto loans, as these will take longer to pay off and cost more in interest, all as your car depreciates in value over time. Auto loan debt is secured, which means your car is used as collateral. If you can’t pay your auto loan, your car may be repossessed.

As soon as you suspect you may not be able to make your payment, reach out to the lender. They may work with you to enroll you in a hardship program, which could include forbearance.

Student loan debt

Student loans can help borrowers reach career milestones. Workers with college degrees tend to have higher incomes and lower rates of unemployment, meaning that getting an education can be a good investment in your future. There are two different types of student loans: federal student loans and private student loans. Federal student loans are issued by the federal government, while private student loans are issued by a bank or lender.

The average student loan debt was $36,500 in 2018, according to LendingTree research. Student loan debt is not inherently bad. However, it can be burdensome for new college graduates having a hard time securing well-paying employment.

How to handle student loan debt: Federal student loan borrowers may be eligible for an income-driven repayment plan, which sets the monthly student loan payment based on income and living costs. These plans can reduce payments and offer loan forgiveness after a certain number of years of on-time repayment. Federal student loans also come with borrower protections like forbearance and deferment, which let you pause payments. In some cases, interest may not accrue during deferment.

Private student loans won’t come with income-based repayment, and may not come with other borrower protections. In general, these loans function like personal loans. If you can’t make your payments, get in touch with the lender.

Personal loan debt

Personal loans are the fastest-growing form of consumer debt, according to LendingTree data, with more than 20 million personal loan borrowers in the U.S. A personal loan is an unsecured loan (meaning it requires no collateral) that can be used to pay for virtually anything. Since this type of financing is unsecured, it may come with higher APRs than secured financing. Lenders rely heavily on factors like your credit score and DTI ratio to determine personal loan eligibility and terms.

Personal loans are commonly used to consolidate high-interest debt, make home improvements and finance large purchases. Like many other types of debt, personal loans can be used to advance your financial situation, but personal loans with high APRs may be costly for borrowers in the long run.