LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

The States Homeowners Have Moved to — and Stayed in — During the COVID-19 Pandemic

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

The housing market has boomed throughout the coronavirus crisis. Millions of houses have been bought and sold, and home prices have skyrocketed across much of the U.S. Based on how energetic the housing market has been, it’s clear many Americans have relocation on their minds — even in the face of the COVID-19 pandemic.

But where are movers likely to go? Are they staying in their state or venturing somewhere new? To answer these questions, we looked at data derived from LendingTree users who requested a mortgage loan from March 1, 2020, through Sept. 21, 2021. This allowed us to analyze the pandemic moving patterns of homebuyers in each of the nation’s 50 states.

While most movers look to stay in their current state, a significant share look to move elsewhere. And some states are much more popular destinations than others.

TABLE OF CONTENTS

Key findings

- 85.38% of movers, on average, stay in the state in which they’re living. Movers tend to remain in their current state, not only because out-of-state moves are usually more expensive than in-state ones, but the social and economic ties they’ve forged within their current area can be hard to replicate elsewhere.

- Texas residents love the Lone Star State. Texas has the highest percentage of residents looking to move within the state at 93.33%. Not only is Texas popular among its residents, but its relatively inexpensive home prices and lack of a state income tax also make it a popular destination for out-of-state movers from places like Alaska, Colorado and California.

- New York has the highest percentage of residents looking to leave. Just 73.35% of New York state residents want to stay in the Empire State. Of those who leave, many don’t go far, as New Jersey is the most popular destination for out-of-state movers.

- A majority of out-of-state movers don’t go far. The most popular new destination for homebuyers in 27 states bordered the state from which they were moving.

- For out-of-state movers, Florida is the No. 1 destination. Florida is the favorite out-of-state destination for mortgage shoppers in 18 of the 50 states. The Sunshine State has a long history of bringing in visitors and new residents, particularly retirees, thanks to a mix of affordable housing, no state income tax and sunny weather. Florida also retains residents, with the third-highest share of movers who look to stay in state.

States with the most movers looking to stay in state

No. 1: Texas

- Percentage of movers staying in state: 93.33%

- Percentage of movers relocating out of state: 6.67%

- Most popular destination state: Florida

- Percentage of Texas movers looking to move to Florida: 11.40%

No. 2: Oklahoma

- Percentage of movers staying in state: 91.43%

- Percentage of movers relocating out of state: 8.57%

- Most popular destination state: Texas

- Percentage of Oklahoma movers looking to move to Texas: 26.16%

No. 3: Florida

- Percentage of movers staying in state: 91.17%

- Percentage of movers relocating out of state: 8.83%

- Most popular new destination state: Georgia

- Percentage of Florida movers looking to move to Georgia: 16.50%

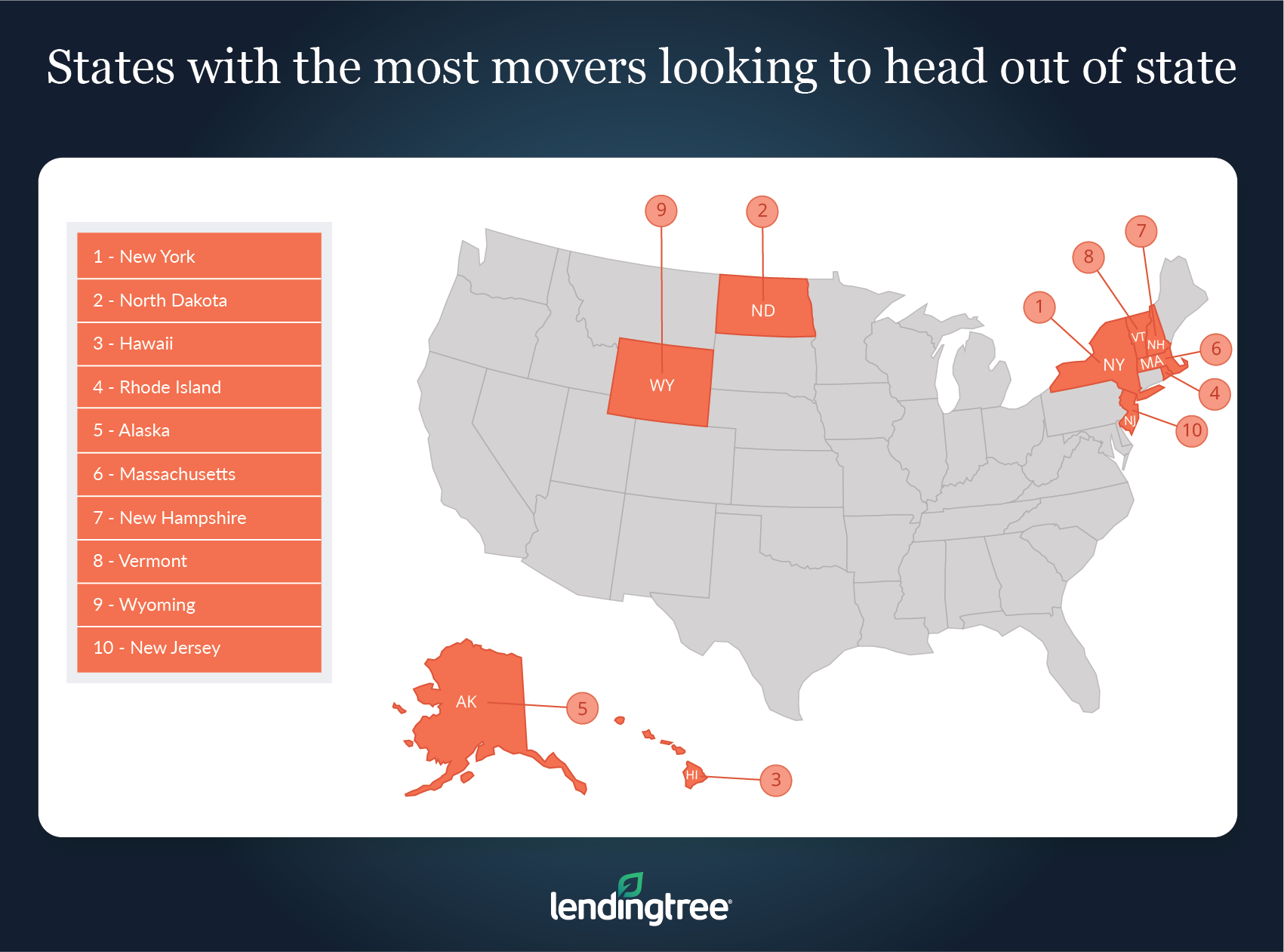

States with the most movers looking to head out of state

No. 1: New York

- Percentage of movers staying in state: 73.35%

- Percentage of movers relocating out of state: 26.55%

- Most popular destination state: New Jersey

- Percentage of New York movers looking to move to New Jersey: 20.95%

No. 2: North Dakota

- Percentage of movers staying in state: 77.33%

- Percentage of movers relocating out of state: 22.67%

- Most popular destination state: Minnesota

- Percentage of North Dakota movers looking to move to Minnesota: 29.65%

No. 3: Hawaii

- Percentage of movers staying in state: 78.06%

- Percentage of movers relocating out of state: 21.94%

- Most popular destination state: California

- Percentage of Hawaii movers looking to move to California: 13.02%

People have moved throughout the pandemic, but most haven’t gone too far

With the rise of remote work, it may seem as though Americans have more freedom to buy a home wherever they choose — even if that place happens to be far from where they live and work.

And while some certainly have decided to pack their bags and head for greener pastures, the data indicates that most movers stay close. As mentioned above, an average of just more than 85% of movers look for a home in their current state. Similarly, a December 2020 LendingTree study found that about 84% of movers in the nation’s 50 largest cities stayed in the city in which they were living.

People may want to avoid a long-distance move for a variety of reasons: Here are just a few:

- Uncertainty about working from home: Many still temporarily working remotely are unsure how long the setup will last. It can make sense to remain in the same area if employers start calling workers back to the office.

- A desire to save money: Because many movers and truck rental companies charge by the mile, it’s usually much cheaper for a mover to stay near where they currently reside than it is for them to haul all their stuff across the country.

- An unwillingness to sever bonds with their community: Many people have social ties to their current location. Even if consumers could afford to move out of state, some would choose to stay local to remain close to their friends and family or avoid switching their child’s school. Because of these ties, it’s often not worth it on an emotional level to leave an area.

Ultimately, even for those who have been inclined to move during the pandemic, certain drawbacks and limitations — both socially and financially — are likely to keep most movers near where they currently reside.

3 tips for homeowners considering a move

Even considering short distances, moving can be a challenge. As a result, those looking to move should keep the following tips in mind to help make the process less of a hassle.

No. 1: Learn about a new market before deciding to move into it

Different housing markets have different quirks, so try to get acquainted with the area before buying a home there. Compare home prices in similar neighborhoods to get a better idea of how much money a house is likely to cost in a given area, as well as which homes might be overpriced or underpriced.

No. 2: Keep an eye on savings

The combination of costs related to moving expenses, selling a house and buying a new one can add up quickly — and easily drain a person’s bank account. As a result, movers should keep a careful eye on their savings to ensure they have enough money to move.

No. 3: Consider other options

Depending on why a person is thinking about moving, there may be ways to accomplish their goals without packing their bags. For example, those thinking about moving to lower their monthly housing costs might instead consider refinancing their loan. Or those who want a house with more updated amenities may be able to use a home equity loan to get those amenities in their current home.

Methodology

Data for this study is derived from users on the LendingTree platform who made a mortgage purchase request from March 1, 2020, through Sept. 21, 2021.

By comparing the location of a buyer’s current residence to the location of the residence they’re looking to purchase, LendingTree was able to determine which state a homebuyer was looking to move to and whether they were moving to a new state or staying in the one in which they live.