LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

USDA Eligibility Maps: How to Use in Your House Hunt

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

While not everyone associates the U.S. Department of Agriculture (USDA) with mortgage financing, an ideal place to find out about USDA loans is to start with the USDA eligibility map.

USDA mortgage loans offer 100% financing and low mortgage rates for low- and moderate-income borrowers who buy property in a rural area. But don’t assume that means you must live on a farm. The “rural” definition includes towns with a population up to 20,000 if they’re not in a metro area and don’t have homeownership programs for low- and moderate-income buyers.

What is the USDA eligibility map?

The USDA eligibility map offers a searchable method to determine where there are homes that can be financed with a USDA loan. Since USDA loans are limited to homes that meet the definition of a rural location, one of the first steps to applying for a USDA loan is to see if the neighborhood where you want to buy a home qualifies as rural.

If you already have a home in mind to buy, you can use the USDA eligibility map to check that address to see if USDA financing is an option.

If a property is located in an area designated as rural on the USDA eligibility, that doesn’t mean you can definitely finance it with a USDA loan. The USDA has a disclaimer to explain that eligibility on the map is not a guarantee of eligibility or of an approved loan. A loan application must be reviewed to determine eligibility.

What does ‘property eligibility’ mean?

While all lenders review the value of a property before deciding if they will approve a mortgage, the USDA loan program is designed to provide loans for low- and moderate-income households living in rural areas. The loan program is focused on improving access to affordable homeownership in rural areas.

The USDA eligibility map offers an initial way to search locations and identify areas where USDA loans are available. Only properties within areas designated as rural qualify for the loan program. If you’re shopping for a home in an area that could be defined as rural, checking the USDA property eligibility map is a first step to see if USDA financing is available.

USDA property eligibility requirements

Mortgage loan programs typically require borrowers to meet specific requirements and a property appraisal. The USDA loan program has additional requirements because of the program’s mission to support affordable homeownership in rural areas for low- to moderate-income households.

Eligibility requirements for USDA loans include:

- The property must be located within a rural area that is designated as eligible for USDA loans.

- The property must be a single-family dwelling and not an apartment building. By USDA’s definition, this includes detached single-family homes; attached homes such as a duplex, townhouse or villa; a condo; a modular home or a manufactured home.

- The home can be located in a planned unit development.

- The home must meet the Department of Housing and Urban Development’s (HUD) 4000.1 minimum standards that also apply to homes financed with an FHA loan.

- There’s no set maximum purchase price — applicants must qualify for loan repayment, which will impact the maximum price.

- There’s no limit on the amount of acreage that comes with the property.

- There are no “seasoning” requirements, which means that properties that have been “flipped” by the previous owner may be purchased. Flipped homes typically refer to a home that’s been purchased, renovated and sold within a short period of time.

What qualifies as a designated rural area?

While you may think a rural area is defined by farms, fields and tiny villages, the USDA definition of a designated rural area is broader.

According to the USDA, an area can qualify as “rural” if it has:

- A population of no more than 2,500 people

- A population between 2,500 and 10,000 if it’s rural in character

- A population between 10,000 and 20,000 but isn’t part of a metropolitan statistical area (MSA) and doesn’t offer mortgage programs for low- to moderate-income families

How to use the USDA eligibility map

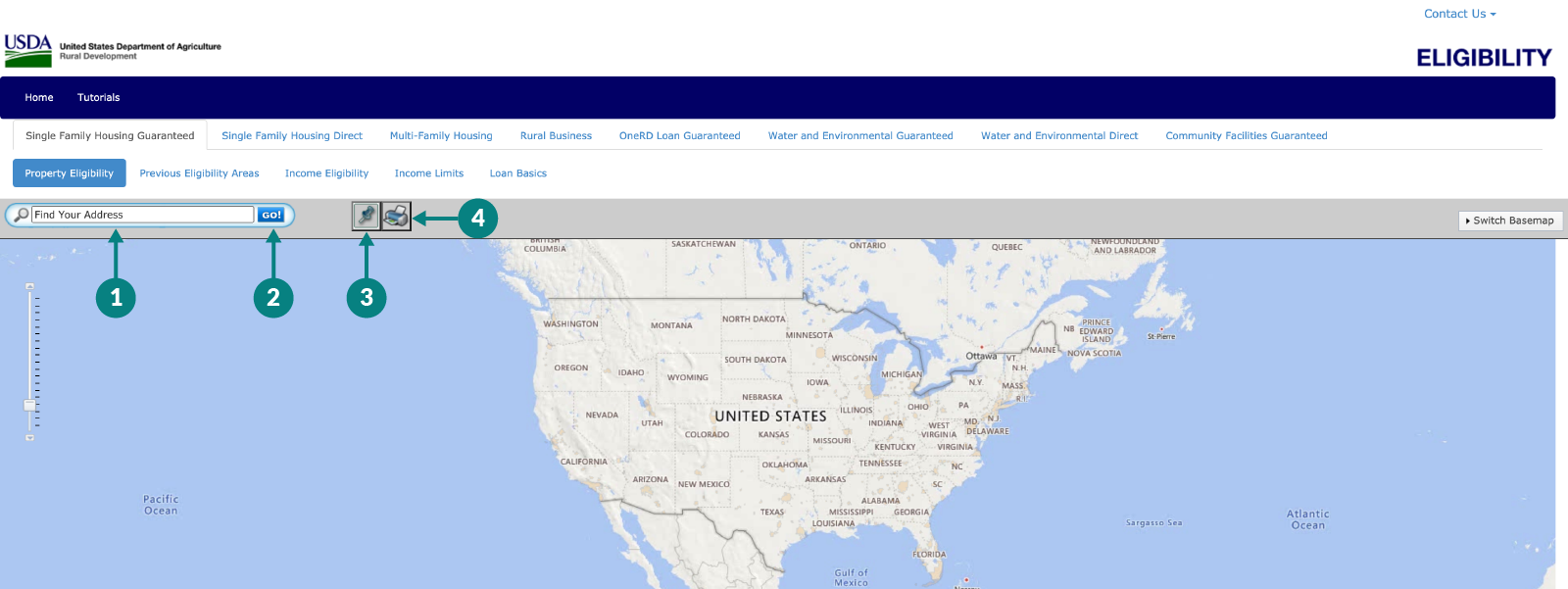

Whether you have a property in mind that you want to buy or you want to look for USDA eligible homes, start by opening the USDA eligibility map and follow these steps:

- If you have a specific address to check, type the full address (including the ZIP code) into the search bar on the map. Then, click “Go” next to the search bar.

- The map will zero in on the address and put a pushpin on the location. Then, you’ll see a pop-up that will let you know immediately if that address is or is not located in an eligible area.

- If you want to continue searching on the map for another address, click on the pushpin icon above the map next to the search bar.

- If you want to print a copy of the map at any time, you can click on the printer icon located next to the search bar.

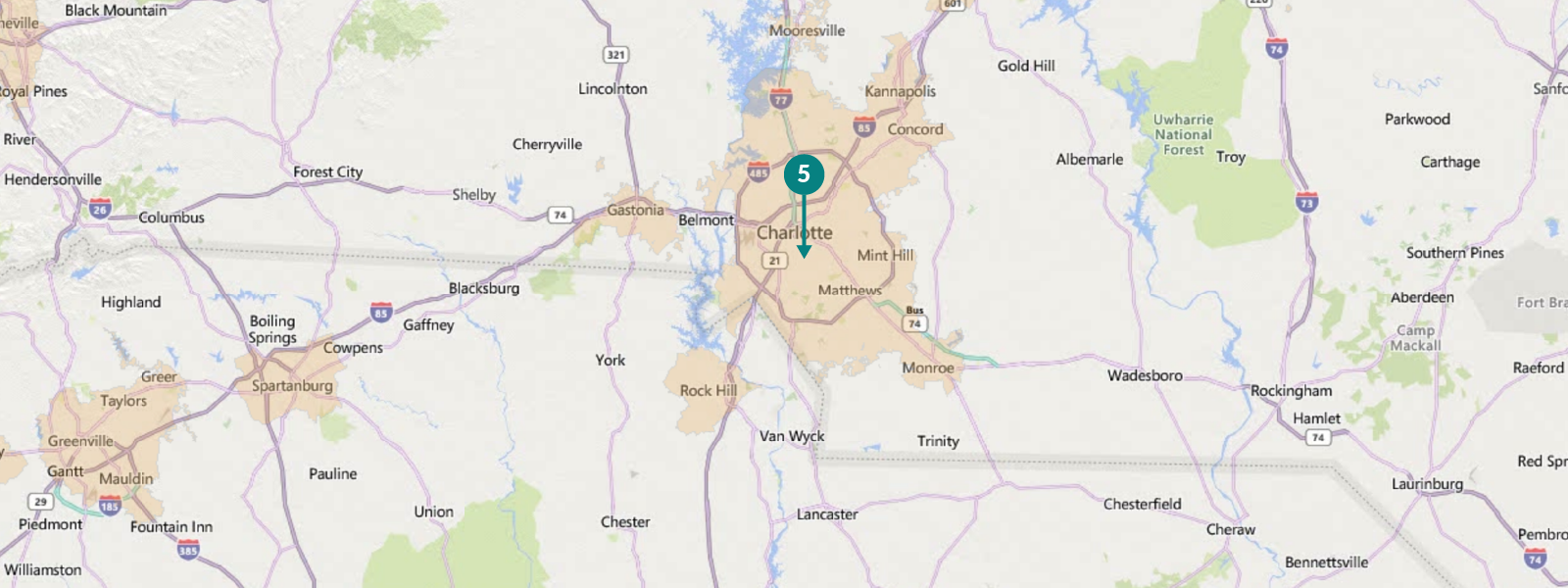

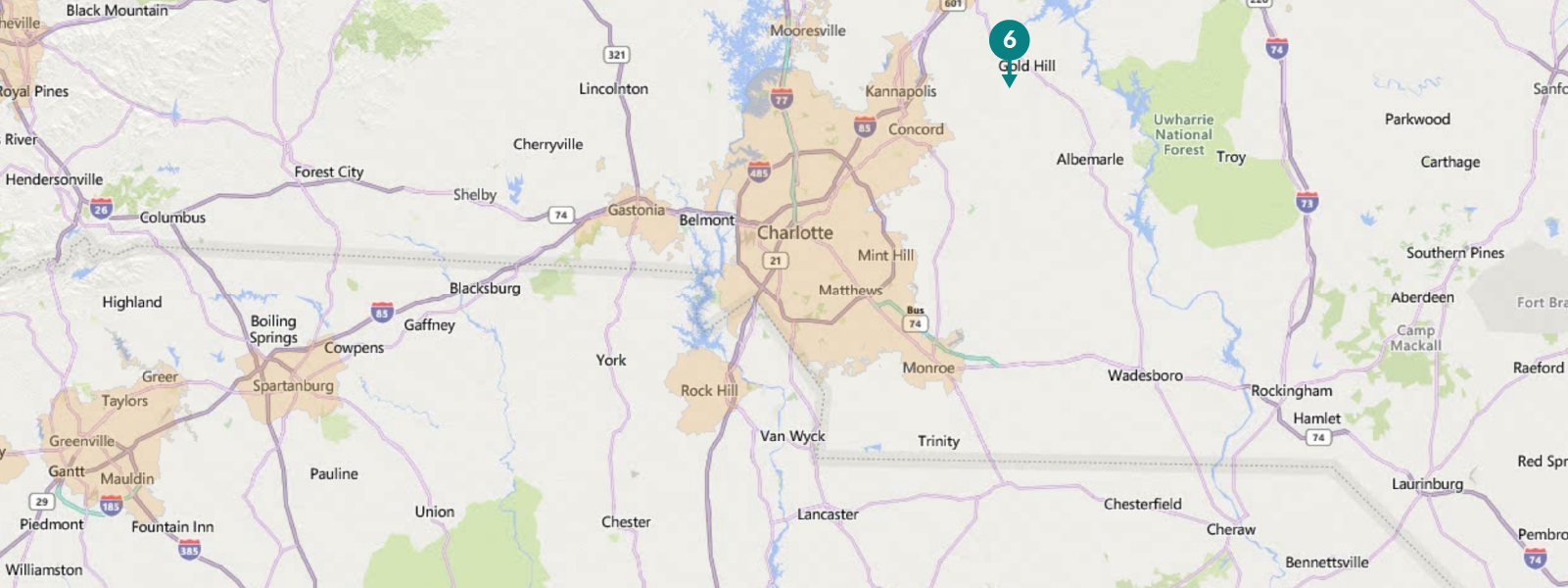

- If you don’t have a property address to check, you can zoom out on the map and look at a larger area. You’ll notice that some areas have a peach-colored background and others are white. The peach tone indicates that homes in that region are not in USDA eligible areas. Homes in the sections of the USDA loan map with a white background are generally USDA eligible homes.

- In addition to looking at the color indicators on the USDA property eligibility map, you can click on the pushpin icon and drop it in any location on the map. A pop-up box will tell you whether that location meets USDA property eligibility requirements.

- If you want to clear the USDA eligibility map to start a new search, simply refresh your browser.

Zooming in and out on the USDA loan map can give you an idea of where properties are available that may meet USDA qualifications. While USDA loan requirements start with the location of a property, there are other USDA loan qualifications to meet.