LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

Personal Loan APR vs. Interest Rate: What’s the Difference?

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

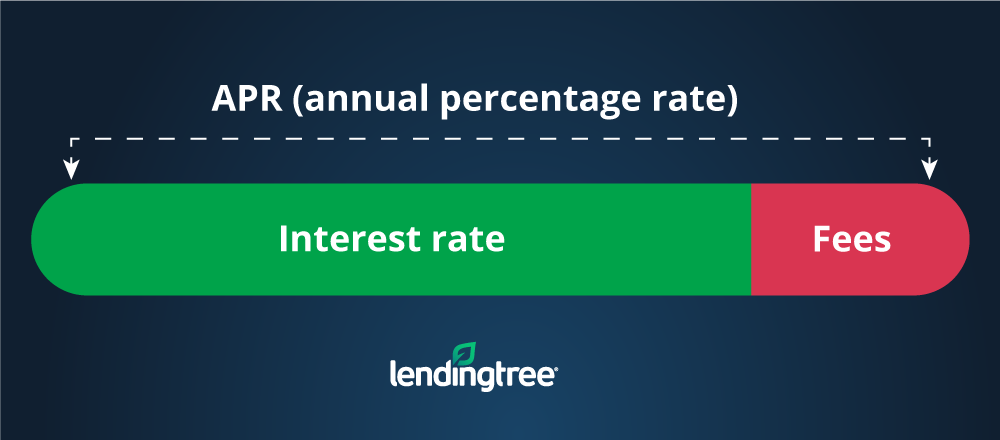

Understanding the concepts of interest rates versus APRs for personal loans can help you secure a loan with the lowest possible cost. Interest rate is a percentage of a loan paid to the lender, while APR is a broader measure of the cost of a loan, including interest and origination fee. In other words, interest rate is just one factor in measuring APR. The lower your APR, the lower the overall cost of a loan will be.

Interest rate vs. APR, explained

Interest rate and APR are typically not interchangeable. The difference between interest rate and APR is simple: your interest rate is just part of your APR.

What is an interest rate?

A personal loan interest rate is the amount that a lender charges you to borrow the loan. It’s expressed as a percentage of the total loan amount. Since personal loans are typically unsecured, meaning they don’t require collateral, the lender sets the interest rate based on your perceived ability to repay the loan.

To determine the interest rate, lenders look at your credit score and debt-to-income ratio, among other factors, like loan amount and loan length. Different lenders will have different interest rate ranges.

What is an APR?

APR is the total yearly cost of the loan, including interest plus fees. One common fee that factors into APR is the origination fee, which is a one-time cost that’s charged when you receive your loan. It typically ranges from 1% to 8% of the total cost of the loan.

Some lenders do not charge an origination fee. For no-fee loans, your interest rate is the same as your APR. That doesn’t mean that no-fee loans are always cheaper than loans with origination fees. For instance, a loan with an origination fee (but a lower APR) could be more cost-effective than an alternative loan without fees (but a higher APR).

How APR (not fees alone) effect the cost of a 3-year, $10,000 loan

| Loan #1 | Loan #2 | |

|---|---|---|

| Origination fee | None | 5% |

| Interest rate | 20.00% | 11.41% |

| APR | 20.00% APR | 15.00% APR |

| Monthly payment | $372 | $347 |

| Total cost of the loan | $13,379 | $12,480 |

| Interest and fees paid | $3,379 | $2,480 |

Costs are rounded to the nearest dollar.

How to get a great APR on a new personal loan

Your creditworthiness – and that of your cosigner or co-borrower, if applicable – is the primary factor in determining your interest rate and APR on a personal loan. If you have a good payment history on your credit report, a good or better credit score as a result, and stable employment history, it’s possible that you’ll qualify for a good APR, perhaps even a single-digit one.

With that said, a great APR for one borrower may not be so great for another. A truly great APR allows you to repay your balance on time, or ideally ahead of schedule, without harming other aspects of your personal finances.

If you prequalify for personal loans to receive APR quotes, only to find them too high for your situation, you could pause your applications and instead work on your credit score, or enlist a personal loan co-applicant.

How to compare personal loan rates

Because APR comprises more than just interest rate, looking at APRs from various lenders side by side will help you make more objective, apples-to-apples comparisons. Confirm that the person loan preapproval you might receive shows APR (not solely interest rate) so that you can shop around to make an informed decision.

Also, keep in mind that some lenders advertise APRs that already account for discounts, such as an autopay discount that shaves percentage points off the interest rate.

Here are examples of lenders that promote ranges of APRs for personal loans:

| Lender | APR range |

|---|---|

| Best Egg | 5.99% - 35.99% |

| FreedomPlus | 7.99% - 29.99% |

| Happy Money (formerly Payoff) | 5.99% - 24.99% |

| LendingClub | 7.04% - 35.89% |

| LendingPoint | 7.99% - 35.99% |

| LightStream | 3.99% - 19.99% |

| Marcus by Goldman Sachs® | 6.99% - 19.99% |

| OneMain Financial | 18.00% - 35.99% |

| Prosper | 7.95% - 35.99% |

| SoFi | 6.99% - 22.23% |

| Upstart | 4.37% - 35.99% |

Your APR should be simple to find; in fact, the Truth in Lending Act states that lenders must be transparent about the terms and cost of a loan. Your loan agreement should disclose the:

- APR

- Loan amount

- Loan length

- Interest rate

- Fees

Before you take out a personal loan, read your loan agreement carefully to make sure the terms are favorable and you’re able to repay what you borrow.

The importance of APRs when borrowing money

Since your APR is the measure of the total cost of the loan, a lower APR equals a lower cost of borrowing.

For example, let’s assume a good-credit borrower takes out a $15,000 personal loan that’s repaid in fixed monthly payments over five years. The borrower can save money on monthly payments and the overall cost of the loan by choosing the option with the lower APR:

How APR affects borrowing costs on a 5-year, $15,000 loan

| Loan #1 | Loan #2 | |

|---|---|---|

| APR | 9.50% | 11.50% |

| Monthly payment | $315 | $330 |

| Total cost of the loan | $18,902 | $19,793 |

| Interest and fees paid | $3,902 | $4,793 |

Costs are rounded to the nearest dollar.

Even with just a difference in APR of two percentage points between these two hypothetical loans, the lower-rate amounts to nearly $1,000 less in interest charges. When you compare loan offers and choose the loan with the lowest possible APR, you can save on the overall cost of borrowing.

What is the average personal loan rate?

Because APRs vary by the strength of a borrower’s application (and their requested loan amount), it’s wise to consider averages along different credit score ranges. Once you know your credit score range, here are rates you could expect to be quoted:

Personal loan statistics by borrower credit score

| Credit score range | Average APR | Average loan amount |

|---|---|---|

| 720+ | 10.73% | $17,753 |

| 680-719 | 19.04% | $13,784 |

| 660-679 | 24.74% | $10,811 |

| 640-659 | 30.18% | $8,872 |

| 620-639 | 37.09% | $7,281 |

| 580-619 | 65.93% | $5,897 |

| 560-579 | 102.36% | $4,130 |

| Less than 560 | 156.11% | $2,799 |

Source: LendingTree customer data for Q1 2021.

How to calculate APR on a loan

To calculate a personal loan APR, you’ll need to know your…

- Loan amount

- Finance charges (such as origination fee)

- Interest rate

- Loan length (or term)

The easiest way to calculate your APR (without simply referring to your loan agreement) is to plug these figures into a simple APR calculator, like this one from Student Loan Hero.

You can also use Microsoft Excel to determine your APR. Simply plug the following formula into an Excel sheet:

=RATE(total number of payments, monthly payment amount, loan value)

This formula will give you the monthly percentage rate of your loan. To get the annual percentage rate, simply multiply this number by 12.

What is a good APR for a loan?

Personal loan APRs vary widely depending on a number of factors, including credit score, desired loan amount and loan length. They tend to fall between 10% and 25%, although it varies greatly depending on your credit profile and the lender. In some cases, borrowers may see triple-digit rates, for example. The best personal loan candidates may get rates lower than 6%, while borrowers with poor credit history could potentially see APRs as high as 36% or more.

Whether an APR is “good” depends on your unique financial situation, as well as the loan purpose.

For example, if you want to refinance high-interest credit card debt, then a personal loan with a lower APR than what you’re currently paying on your credit cards can save you money in the long run.

If you want to take out a personal loan for home improvement, you should ensure that the cost of the loan doesn’t offset the value gained from renovations. Use this personal loan payment calculator to determine the total cost of a loan based on your rate.

In general, personal loans used for unnecessary purposes, like vacations or weddings, are typically not advised, since the cost of borrowing will just add to the cost of the original expense. However, borrowers who can secure low APRs may find that the convenience of a personal loan is worth the long-term cost.

If you’re ready to hunt for the best APR for your credit profile, start by seeing what your bank or credit union has to offer, as well as checking out our list of vetted personal loan lenders with competitive rates and service.