LendingTree helps you shop for your best ATV financing rate with powersports loan offers you can compare

LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

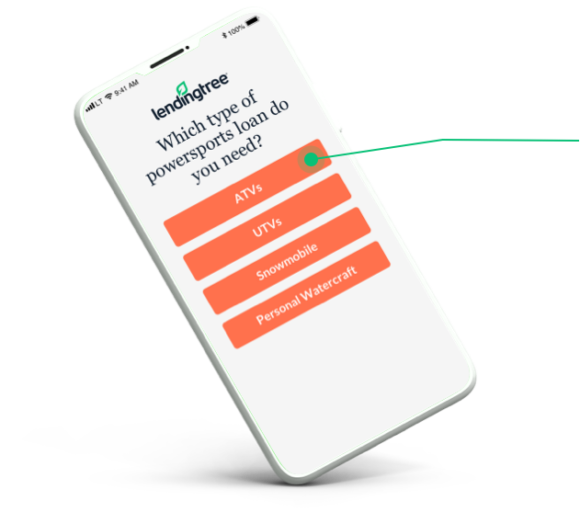

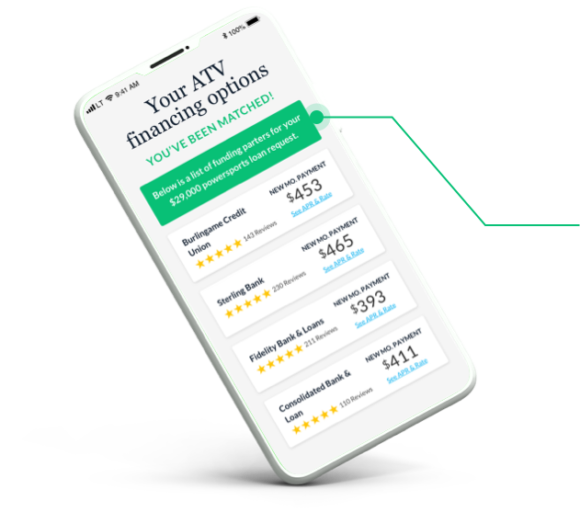

ATV financing doesn’t have to be a challenge — LendingTree makes it easy to find a powersports loan that fits your needs. Compare rates and terms from multiple lenders for new or used all-terrain, utility-terrain or other powersports vehicles.

Benefits of using LendingTree to find your loan include:

You could check and see what your powersports or ATV payment plan would be before you apply for financing by using the loan calculator here.

Whether you know the exact powersports vehicle you want to purchase or you’re shopping around, getting preapproved will make the shopping and purchasing process easier and quicker. Fill out a form on LendingTree to get possible loan amounts as well as rates and terms from up to five lenders, depending on your creditworthiness.

To get preapproved, you’ll need the following items:

A powersports loan from a bank

Banks tend to have great name recognition, 24/7 customer service and versatile mobile apps. However, some banks may not offer powersports or ATV loans, and those that do may not have the best available rates.

ATV financing through a credit union

Credit unions tend to offer lower loan rates than banks. Some have minimal requirements for membership, such as Consumers Credit Union, which only requires a one-time donation of $5.

Borrowing from an online lender

LightStream, the online lending arm of Truist, had the lowest average closed loan rate for powersports borrowers who applied through the LendingTree platform in 2020. But some online lenders offering unsecured personal loans may have higher rates than what you could get elsewhere.

ATV, Jet Ski and snowmobile loans from the manufacturer

Powersports manufacturers, such as Honda, Polaris and Yamaha, may offer financing for the powersports vehicle you want. Depending on the model and when you’re looking to buy, the manufacturer may also offer a rebate as a financing incentive. You may need good to excellent credit to qualify for rebates or low-APR financing.

Powersport financing through the dealership

Most dealers will help you find financing with a lender such as a bank, credit union or manufacturer. But they typically are not themselves lenders. So-called “buy-here, pay-here” dealers may charge high prices and high APRs. If one of the traditional loans we’ve already mentioned isn’t a good fit for you, consider using a credit card, ideally paired with a hefty down payment, or paying cash.