LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

Personal Loan Statistics: 2022

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

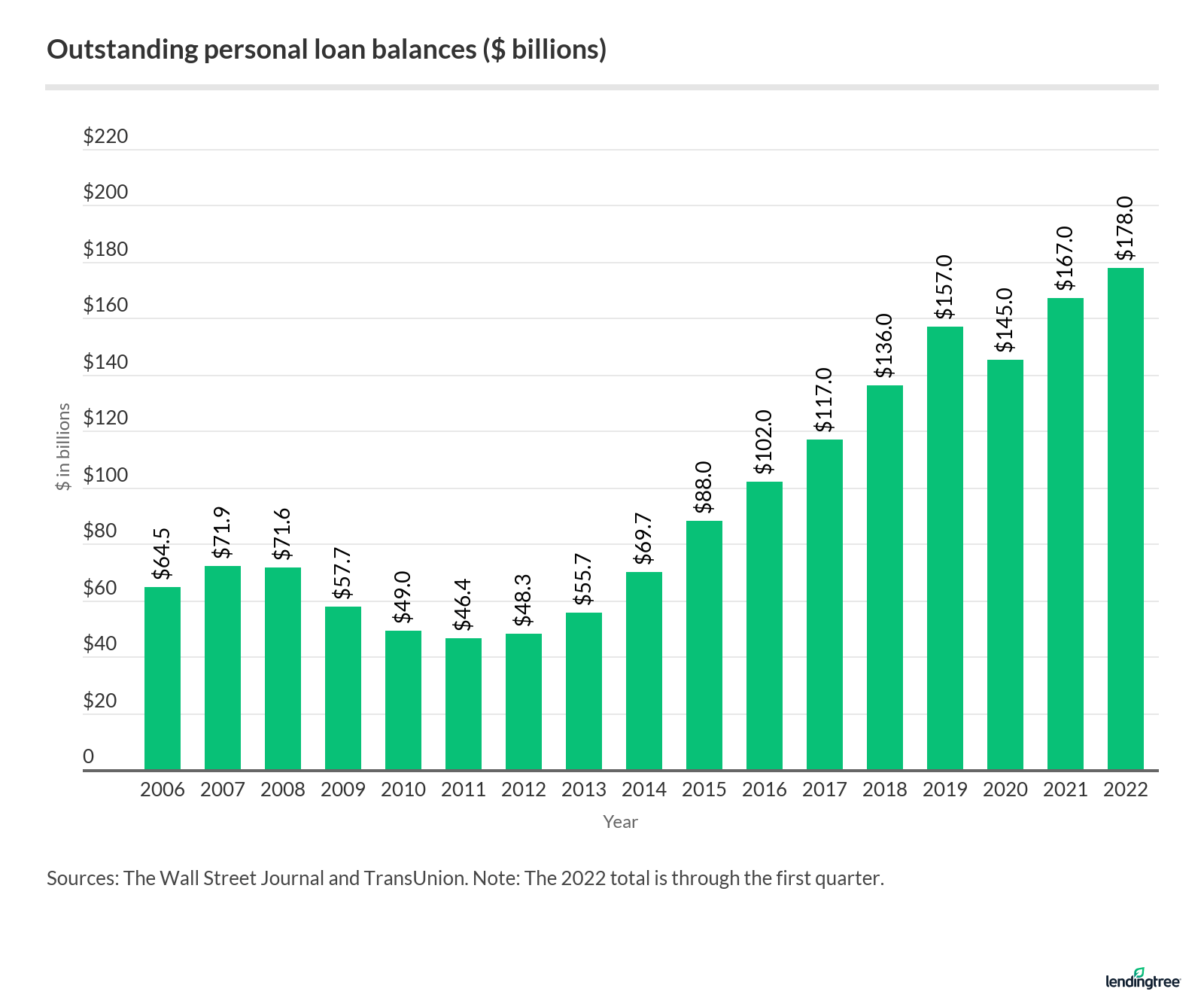

More than 20 million Americans owe a collective $178 billion in personal loans, according to the latest industry data. That’s more than double the $88 billion owed in 2015, showing the growing popularity of personal loans.

The numbers behind the trends can reveal how borrowers are using personal loans — and how they impact consumers’ finances. Check out our personal loan statistics for a deeper look.

- Key facts

- Americans owe $178 billion in personal loan debt

- 20.4 million Americans have a personal loan

- Personal loan growth returns after dropping early in pandemic

- Personal loans account for about 1% of consumer debt

- At least 3% of personal loan accounts are 60 days or more past due

- Average balance on new personal loans jumps above $6,000 — and the APRs owed

- Consumers mostly borrow personal loans to pay down debt

- The bottom line: Expect personal loan debt to keep growing

- Sources

Key facts

- Americans owe $178 billion in personal loan debt as of the first quarter of 2022, up from $144 billion a year earlier. That’s a 24% year-over-year jump.

- 20.4 million Americans have a personal loan as of the first quarter of 2022, up from 19.9 million a year earlier. While personal loan debt is rising, the number of borrowers is down from 20.8 million at the end of 2019.

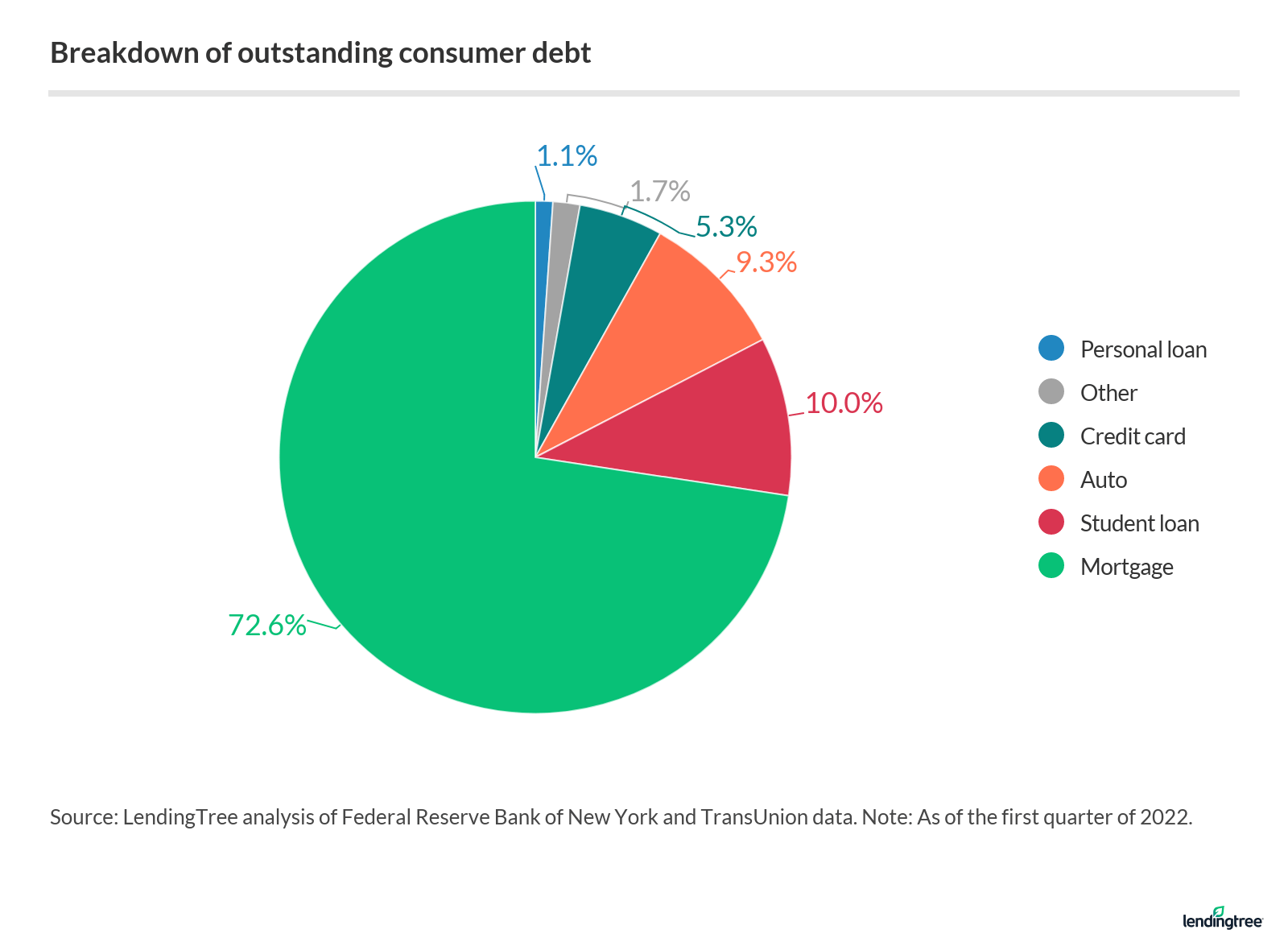

- Personal loan debt makes up 1.1% of outstanding consumer debt in the first quarter of 2022. It accounts for 4.1% of non-housing consumer debt. To compare, Americans owe $841 billion in credit card debt, comprising 5.3% of outstanding debt.

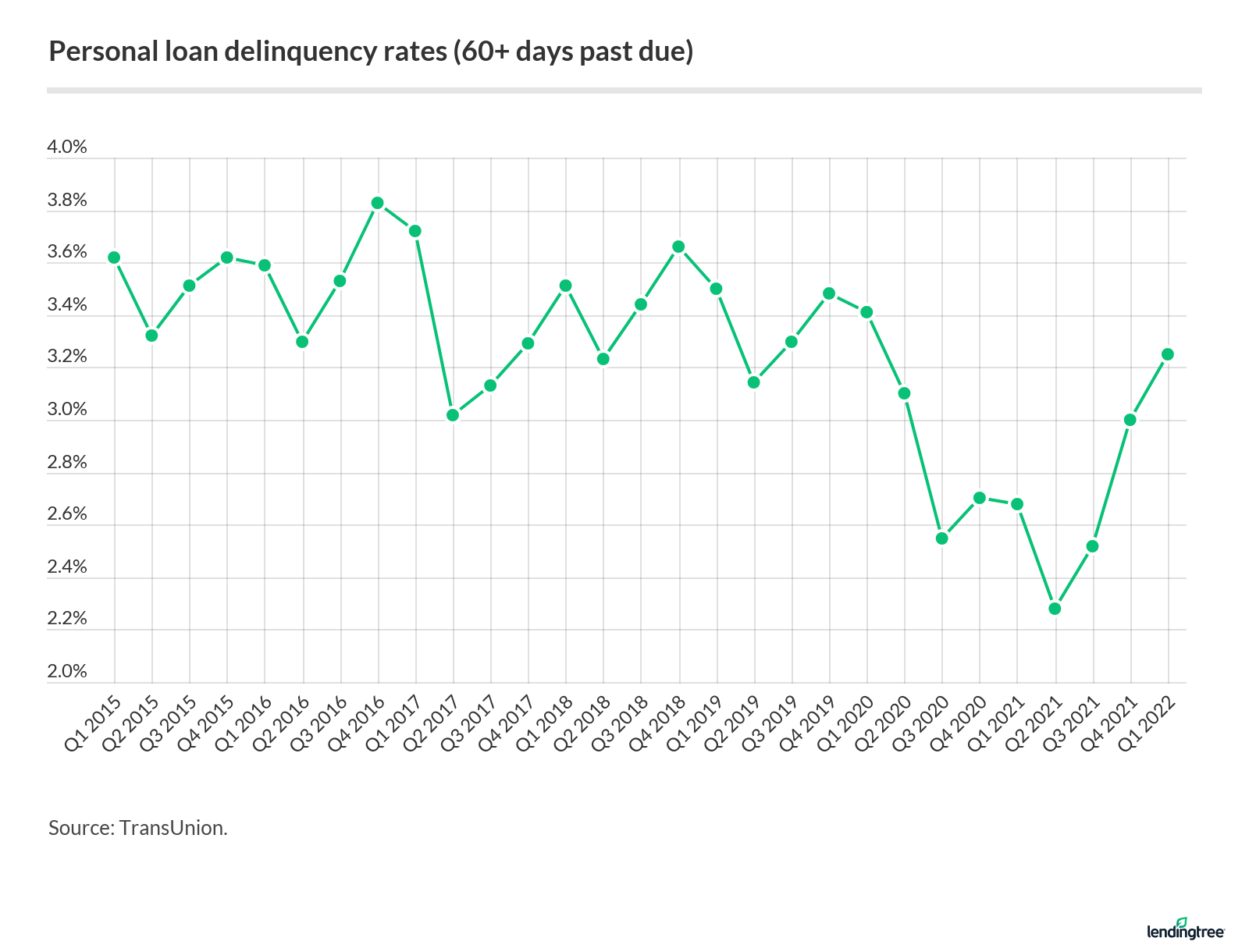

- The delinquency rate (60 days or more past due) for personal loans is 3.25% as of the first quarter of 2022. That’s an increase from 2.68% a year ago.

- The average balance of a new personal loan is $6,656 as of the first quarter of 2022. A year ago, the average personal loan balance was $5,155.

- Nearly 6 in 10 borrowers (57.6%) take out a personal loan to consolidate debt or refinance credit cards. The next-closest reason is home improvements (5.8%).

Americans owe $178 billion in personal loan debt

Personal loans borrowers owe $178 billion in debt as of the first quarter of 2022 — the highest in the 17 years for which data is available. That’s a substantial 24% increase from the first quarter of 2021, when Americans owed $144 billion. (By the end of 2021, outstanding personal loan debt was $167 billion, showing how quickly it increased the rest of that year.)

Here’s an overview of the amounts Americans have owed on personal loans over time.

20.4 million Americans have a personal loan

More than 20 million Americans — 20.4 million, to be exact — have a personal loan as of the first quarter of 2022, up from 19.0 million in the first quarter of 2021.

There are 6 million more consumers with a personal loan today than in 2015, though 20.4 million is lower than the 20.8 million in 2019 before the pandemic.

Personal loan growth returns after dropping early in pandemic

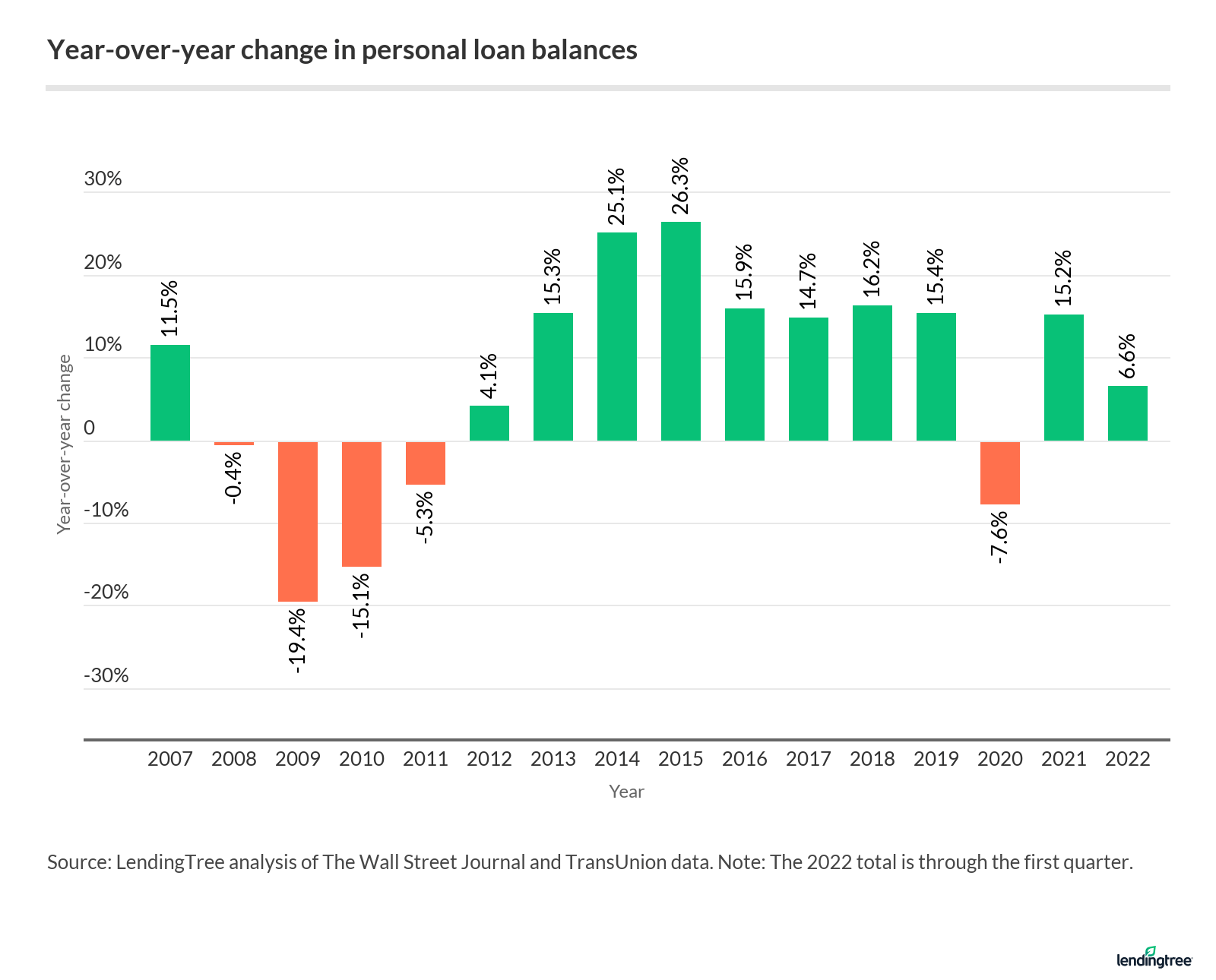

The massive, nearly-decade-long rise in personal loan debt ended in 2020, thanks to the pandemic. Personal loan balances fell 7.6% that year, marking the first decline since 2011.

But personal loan debt balances spiked 15.2% in 2021, reversing the previous year’s downward movement. Balances are already up 6.6% in the first quarter of 2022 compared to the end of the year.

Personal loans account for about 1% of consumer debt

Personal loans continue to make up the smallest sliver — just over 1% — of consumer debt held by Americans despite the substantial growth over the past decade.

Comparatively, Americans owe $841 billion in credit card debt, comprising 5.3% of outstanding debt.

If you remove mortgages from the picture, personal loans account for 4.1% of non-housing debt.

At least 3% of personal loan accounts are 60 days or more past due

An estimated 3.25% of personal loan accounts are 60 days or more past due as of the first quarter of 2022 — an increase from 2.68% as of the first quarter of 2021. That figure is also significantly higher than rates for other common loan types, such as auto loans (1.63%), credit cards (1.61%) and mortgages (0.63%).

Despite personal loan delinquency rates being high compared to other loan types, it’s interesting to compare today’s figures to the delinquency rate of 4.77% on consumer loans in 2009 when the Great Recession ended.

Average balance on new personal loans jumps above $6,000 — and the APRs owed

The average balance on new personal loans crossed the $6,000 threshold after remaining below that amount for the past three years.

The average balance on new personal loans is $6,656 as of the first quarter of 2022, compared with:

- $5,155 in the first quarter of 2021

- $5,548 in the first quarter of 2020

- $5,332 in the first quarter of 2019

On average, borrowers with credit scores of 660 or higher see personal loan APRs competitive with the credit card APRs they would receive.

The average APR on new credit card offers is 20.17% as of June 2022, ranging between 16.53% and 23.79%. As the chart below shows, the average person with excellent credit who applies for a personal loan is getting a far better rate than that.

Personal loan statistics by borrower credit score

| Credit score range | Average APR | Average loan amount |

|---|---|---|

| 720+ | 9.81% | $18,812.69 |

| 680-719 | 16.01% | $15,214.76 |

| 660-679 | 23.54% | $11,727.69 |

| 640-659 | 28.93% | $9,470.86 |

| 620-639 | 35.98% | $7,350.97 |

| 580-619 | 54.17% | $5,746.62 |

| 560-579 | 85.24% | $4,250.88 |

| Less than 560 | 135.83% | $2,817.03 |

Source: LendingTree user data on closed personal loans for the first quarter of 2022.

However, subprime borrowers — who may not be eligible for other credit — generally have to pay far higher rates on their personal loans (if they even have loan offers extended to them).

Consumers mostly borrow personal loans to pay down debt

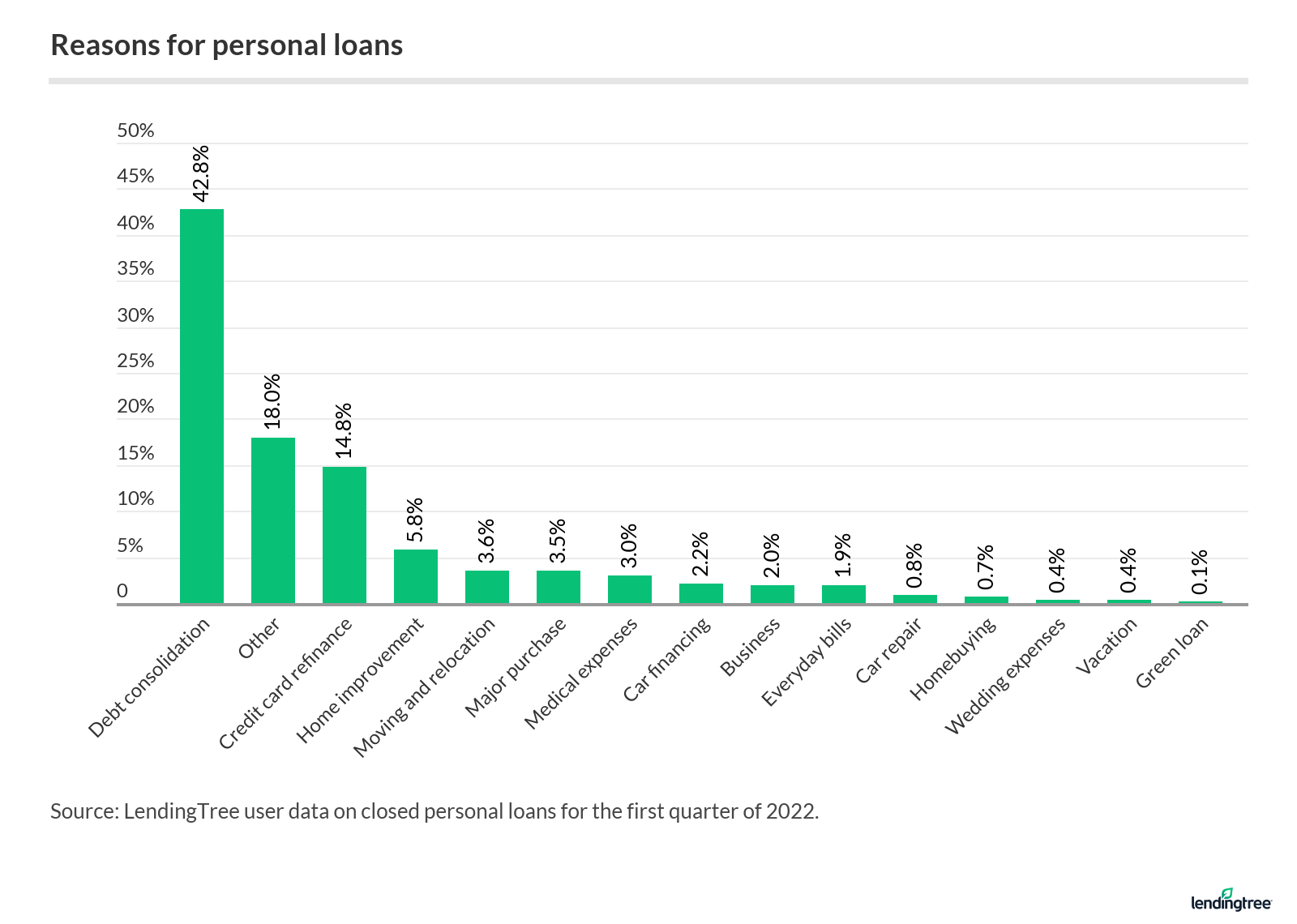

Nearly 6 in 10 (57.6%) LendingTree users seek personal loans to pay down debt, including 42.8% for debt consolidation and 14.8% for refinancing credit card debt.

The next most popular uses for a personal loan are paying for home improvements (5.8%) and moving and relocation (3.6%).

These personal loan statistics underline how important it is for borrowers to practice caution and wisdom when using this product.

Borrowers who use this product can come out ahead but only if they weigh the decision, find a favorable personal loan and practice responsible debt management.

The bottom line: Expect personal loan debt to keep growing

Personal loan debt is growing rapidly, and that’s not likely to change anytime soon. That’s because credit card debt is rising, too, and will likely continue to do so for the foreseeable future.

When that happens, people look to personal loans to help them get their credit card debt under control. And it can be a great tool for that. If you have really good credit, a 0% balance transfer credit card might be a better choice for consolidating and refinancing other debts — still a personal loan can also be a strong option.

Balances aren’t the only things about personal loans likely to grow in the coming months, though. APRs will almost certainly rise, thanks to the Federal Reserve continuing to push interest rates higher to combat inflation. Delinquency rates will likely move higher, too, as more Americans struggle with rampant inflation, higher interest rates and overall economic uncertainty.

Add all this up, and it’s highly likely that consumer demand for personal loans is going to grow in the coming months. Many folks will struggle with managing those loans, especially if economic conditions worsen. However, those who handle these loans well — especially those who use them to knock down their overall debt — can make a real difference in their financial situation, and that’s a big deal.

Sources

- TransUnion

- The Wall Street Journal

- The Federal Reserve Bank of New York

- LendingTree